Packaging Machinery Outlook 2026

Packaging Knowledge Hub

If you're seeking packaging automation solutions, please contact us, and we'll be delighted to offer you the most tailored solution.

An in-depth analysis of how global economic shifts, labor challenges, and the green revolution are redefining the flexible packaging landscape.

Summary: The Signals Behind the Data

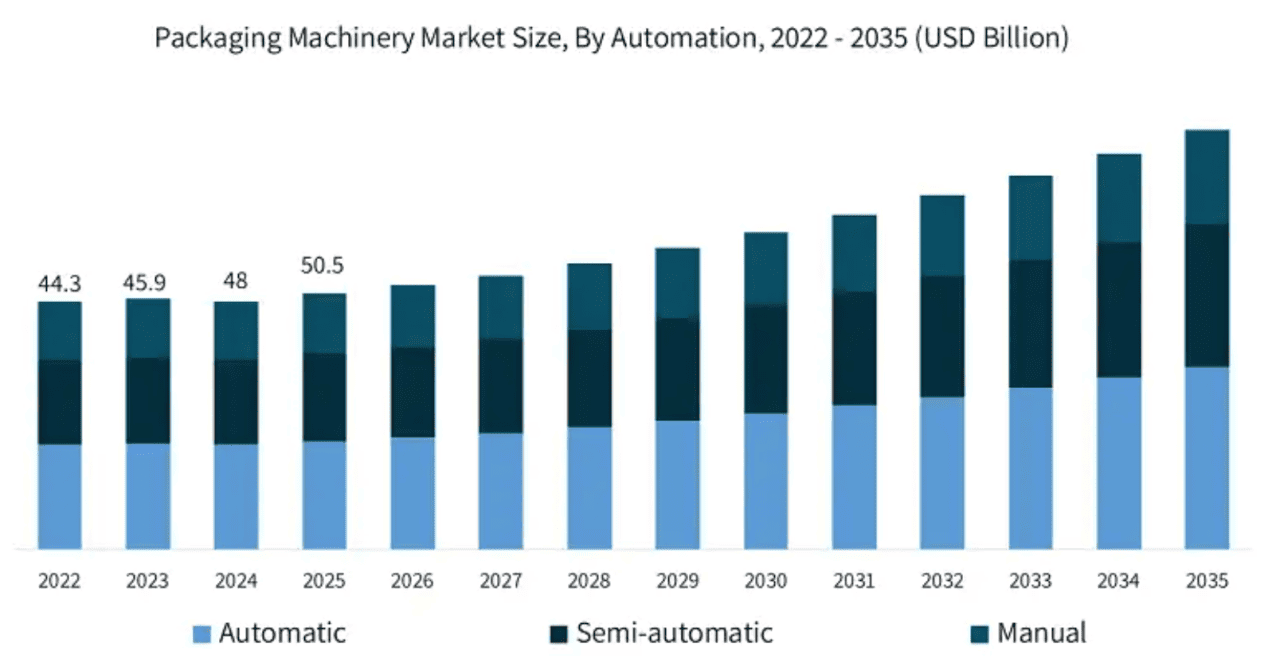

The global packaging equipment market is not just growing; it is evolving at a structural level. According to the latest forecasts, global demand for packaging equipment is set to expand by 5.8% annually, reaching a valuation of $71.1 billion by 2026 (from GMInsights).

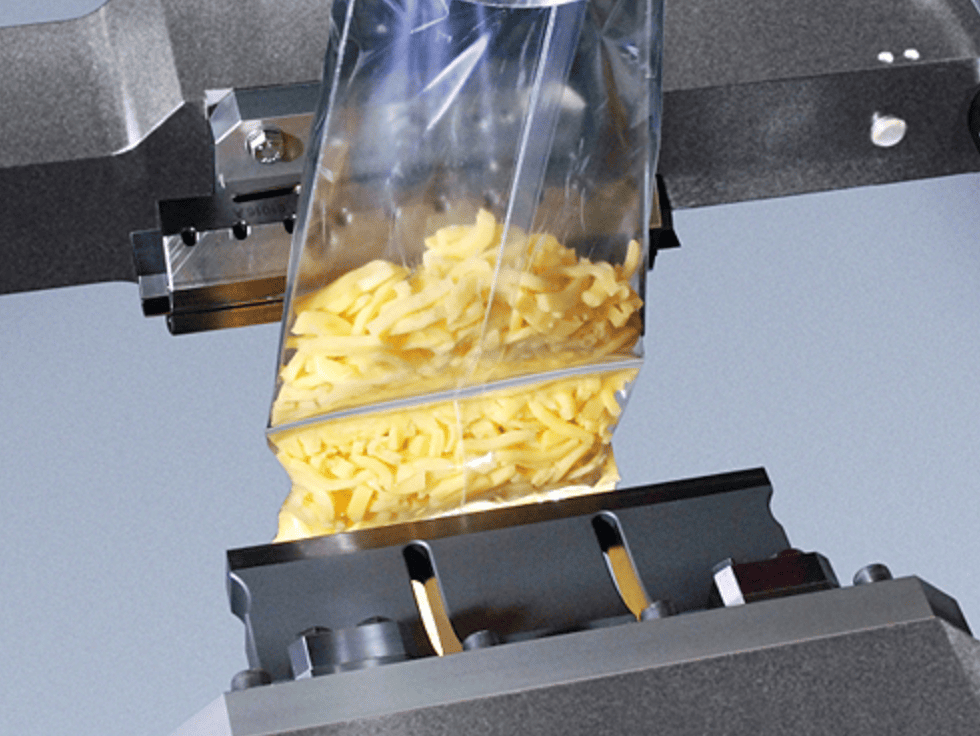

For the bagging and flexible packaging machinery sector—comprising Vertical Form Fill Seal (VFFS) Machines, Horizontal Form Fill Seal (HFFS) Machines, and Premade Pouch Packing machines—this growth represents a critical turning point. The driving force is no longer just about increasing capacity; it is about survival and adaptation.

As manufacturers across the globe face a "perfect storm" of labor shortages, stricter environmental regulations, and the need for extreme production agility, the humble bagging machine is being transformed into a high-tech, data-driven asset.

This article explores the specific trends shaping the bagging machinery landscape through 2026, dissecting the data to provide actionable insights for buyers, OEMs, and investors.

1. The Macro Drivers: Why Demand is Surging

The projected 5.8% expansion is supported by several pillars that directly influence the adoption of Packaging technologies.

The SME Automation Awakening

Historically, advanced packaging automation was the domain of multinational corporations. However, the data reveals a significant shift: small- and mid-sized industrial enterprises (SMEs) around the world are aggressively moving away from manual packaging techniques.

- The Context: In the past, a boutique coffee roaster or a startup snack brand might have relied on manual scooping and hand-sealing.

- The 2026 Reality: With the cost of labor rising and workforce availability shrinking, these SMEs are becoming the primary buyers of entry-level and mid-range VFFS machines. They are not buying for speed; they are buying for consistency and to liberate their limited workforce for higher-value tasks.

- Impact on Machinery: This is driving demand for compact, user-friendly packing machines with "plug-and-play" capabilities that do not require a specialized engineer to operate.

The Export Imperative in Developing Nations

As developing nations (such as Thailand and Vietnam) increasingly export goods to mature markets, they are engaging in the "more intensive use of packaging materials."

- The Shift: To compete on global shelves, a product cannot just taste good; it must survive a 6-week ocean journey and look premium upon arrival.

- The Tech Response: This is fueling demand for bagging machines equipped with Modified Atmosphere Packaging (MAP) capabilities (gas flushing) to extend shelf life, and high-integrity sealing systems to prevent leakage during transit. The era of simple heat sealers in these markets is ending; the era of precision bagging has begun.

2. Regional Powerhouses: The US vs. China

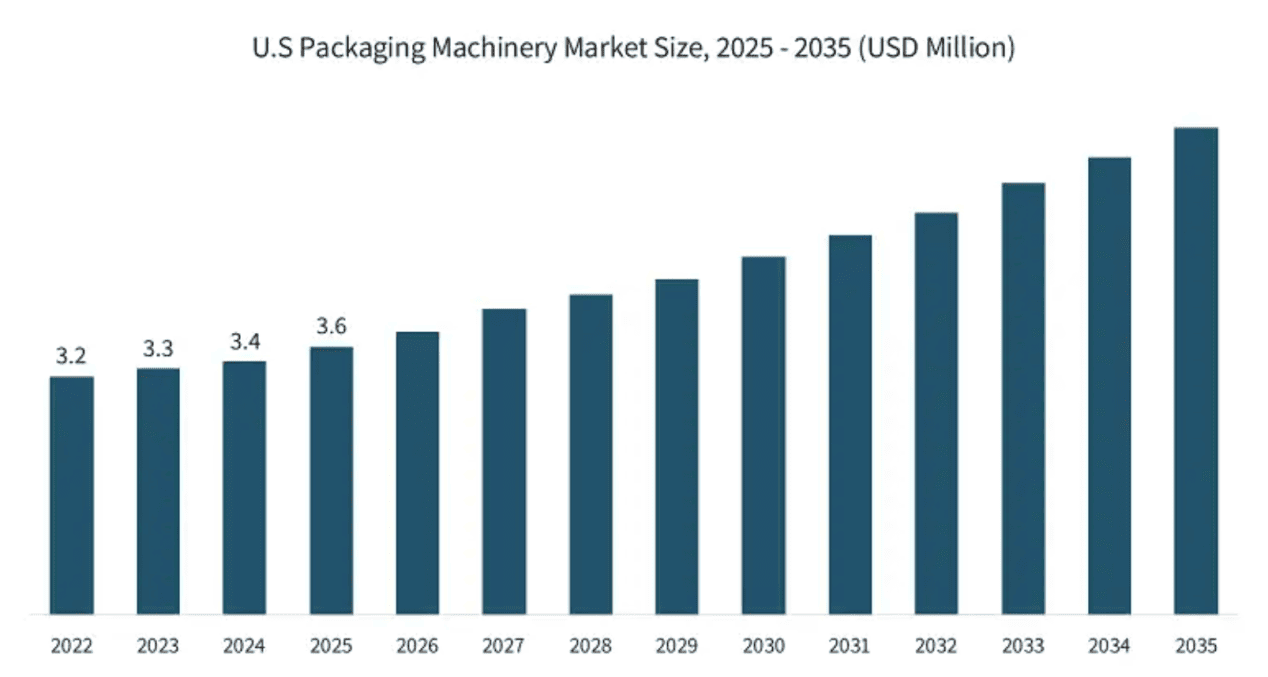

Despite the rise of emerging markets, the United States and China are expected to account for half of all packaging equipment sales growth through 2026. However, the motivations driving bagging machinery purchases in these two giants differ significantly.

The United States: The Quest for Labor Reduction & Customization

In the US, the manufacturing industry is mature, but it faces a severe labor crisis. Consequently, increased spending on advanced packaging technologies is aimed at three goals: boosting productivity, reducing labor costs, and enabling customization.

- The "Dark Factory" Trend: US buyers are seeking bagging lines that can run "lights out." This means VFFS machines integrated with automatic film splicing (to eliminate downtime during roll changes) and auto-correction systems that adjust film tracking without human intervention.

- Hyper-Customization: The US market is driven by marketing variety. A single machine must be able to switch from a pillow bag to a block-bottom bag, and then to a quad-seal bag within minutes.

- Sustainability as a KPI: There is "strong interest" in sustainable packaging. US companies are investing in retrofittable jaws and ultrasonic sealing modules that can handle difficult green materials without slowing down production.

China: Mechanization & Global Competitiveness

In China, the narrative is about the "greater mechanization of packaging processes" and intensifying global competition.

- From Semi-Auto to Full-Auto: While China is a manufacturing behemoth, vast pockets of its industry still rely on semi-automated processes. The push to 2026 involves replacing these legacy systems with fully automated, high-speed rotary pouch packing machines.

- Export-Oriented Quality: As Chinese manufacturers move up the value chain (exporting premium electronics, hardware, and food), they require machinery that meets international safety and aesthetic standards. The demand is shifting from "cheap and fast" to "reliable and precise."

3. The Green Revolution: Machinery for the New Materials

One of the most disruptive forces in the market is the "growing use of green packaging materials," which often requires operators to purchase new equipment.

The "Machinability" Challenge

Sustainable materials—such as Mono-PE (recyclable), paper-based films, or compostable laminates—behave differently than traditional multi-layer plastics. They have narrower heat-sealing windows, are more prone to stretching, and can tear easily under tension.

The Technological Response for 2026

To accommodate these materials, bagging machinery is undergoing a hardware evolution:

- Ultrasonic Sealing: This technology is moving from niche to mainstream. By using high-frequency vibrations rather than conduction heat, ultrasonic jaws can seal mono-materials without melting or distorting them, and can seal through product contamination (like leafy greens or powders).

- Intelligent Tension Control: Servo-driven film transport systems are becoming more sensitive, capable of handling delicate paper films with the "gentle touch" required to prevent breakage.

- Retrofit Kits: We are seeing a surge in demand for OEM conversion kits that allow older machines to run new, eco-friendly films, extending the lifecycle of existing capital assets.

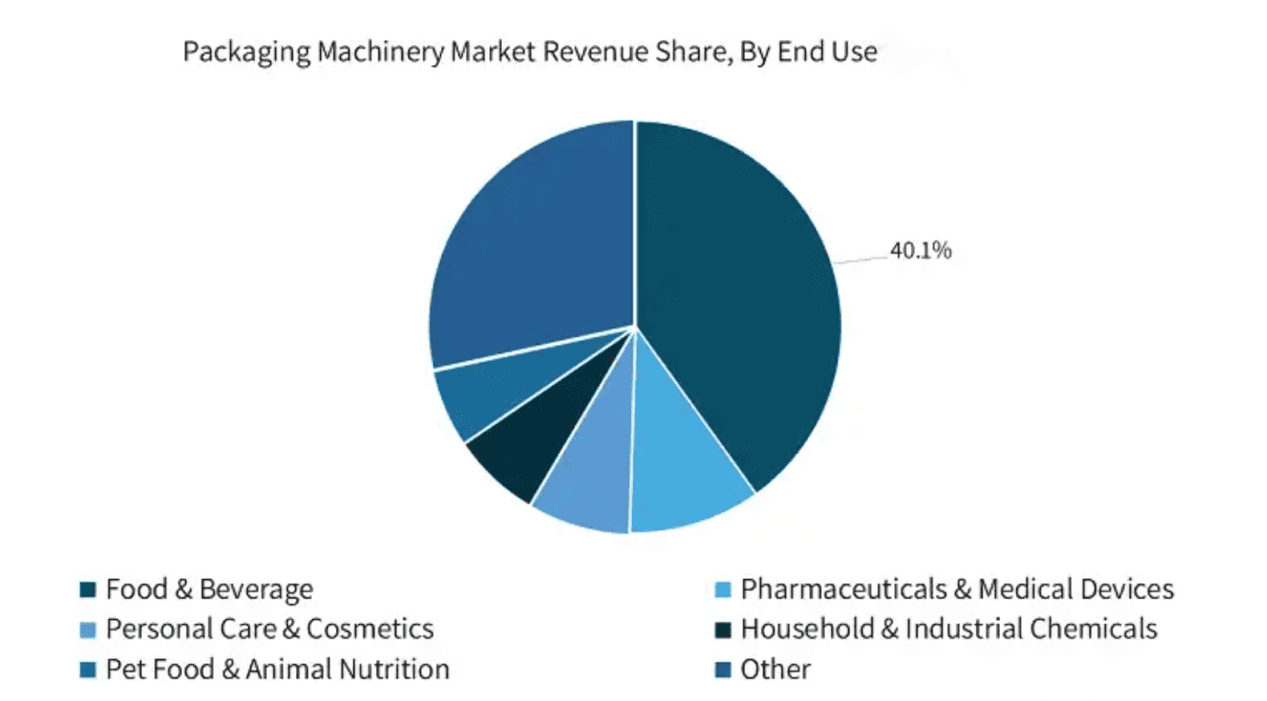

4. The Food Industry: The Unrivaled Giant

The food industry remains the largest market for packaging machinery, accounting for nearly one-third of global gains. As food manufacturers invest in new capacity, their demands for bagging machinery are becoming more specific.

The Need for "Shorter Packaging Runs"

Evolving consumer preferences mean that the days of running the same SKU for a week are over. Brands are launching limited editions, seasonal flavors, and variety packs.

- The Trend: Operators are replacing older machines with models capable of rapid changeovers.

- The Solution: Tool-less changeovers (where parts snap into place without wrenches) and digital recipe storage (where the HMI automatically adjusts seal time, temperature, and pressure for a specific bag size) are becoming non-negotiable features for food companies.

Regulatory Pressure & Food Safety

Growth is also aided by the "strengthening of regulatory frameworks."

- Hygienic Design (IP69K): In the meat, poultry, and dairy sectors, bagging machines must withstand high-pressure washdowns. Open-frame designs that prevent water accumulation and bacterial growth are becoming the industry standard.

- Contamination Detection: We are seeing a tighter integration between bagging machines and inspection equipment. Metal detectors and X-ray systems are no longer separate entities; they are mechanically and digitally integrated into the VFFS frame to reject contaminated bags instantly.

5. Pharmaceuticals & Personal Care: The Fastest Growers

The pharmaceutical and personal care product segment is forecast to expand at the fastest rate of any market through 2026.

The "Deep Pockets" Effect

Pharmaceutical companies have "significant financial resources" and face strict compliance mandates. This makes them the "first adopters of advanced packaging technologies."

Stick Packs and Sachets

Personal Care: As living standards improve globally, the demand for "affordable luxury" in developing markets is driving the sales of single-use sachet machines for shampoos and creams.

Pharma: The trend is moving toward unit-dose packaging (stick packs for powders/liquids), which offers better dosage control than bottles.

Serialization and Track & Trace

Because companies are required to comply with "countless regulations," bagging machinery in this sector is becoming a data hub.

- The Requirement: Every single pouch or stick pack needs a unique code (serialization) for traceability.

- The Machine: By 2026, pharma-grade bagging machines will feature integrated TTO (Thermal Transfer Overprinting) and Vision Systems that verify the code on every package before it is sealed. If the code is unreadable, the machine automatically rejects the pouch without stopping production.

6. Strategic Outlook: Preparing for 2026

The forecast of a $71.1 billion market presents a massive opportunity, but also a risk for those who choose the wrong technology.

For Buyers: The "Total Cost of Ownership" Mindset

In a market defined by labor shortages and material changes, the purchase price of a machine is less relevant than its operational agility.

- Recommendation: When sourcing packaging machinery, prioritize flexibility. Ask: Can this machine run the recyclable film we might switch to in two years? Can it integrate with a Robotic Palletizing if we lose more staff?

- The Trap: Avoid buying "dedicated" machines that can only do one bag style or run one material type. The market is moving too fast for rigid assets.

For OEM: The Service-Based Future

Manufacturers of packaging machinery must pivot from selling "iron" to selling "uptime."

Recommendation: Incorporate IIoT (Industrial Internet of Things) remote access into every machine. With the shortage of skilled technicians globally, the ability to diagnose a VFFS machine in Thailand from a global support center will be a primary selling point.

Conclusion

The road to 2026 is paved with complexity. The 5.8% growth rate is not just a number; it represents a fundamental migration of the global manufacturing base toward automation, sustainability, and digital integration.

For the packing machinery sector, the winners will be the machines that can handle the delicate balance of green materials and high speeds, while requiring less human intervention than ever before. Whether you are a small coffee roaster in the US or a pharmaceutical giant in China, the message is clear: Invest in adaptability, or risk obsolescence.

Get Ready for 2026: Will Your Packaging Line Be a Bottleneck?

This outlook reveals the challenges ahead, but with challenge comes opportunity. Labor shortages, sustainable materials, and rapid market shifts are testing the limits of your existing equipment. It's time to move from reactive fixes to proactive strategy.

Our team of specialists can conduct a complimentary "Future-Readiness Assessment" for your operations. We'll analyze your current bottlenecks and demonstrate how investing in next-generation automated packaging technology—featuring rapid changeovers, green material compatibility, and IIoT remote diagnostics—will deliver a decisive competitive advantage and a strong long-term ROI.

FAQ

Q1: Should I upgrade my old packaging machine or buy a new one?

A: It depends on your machine's age, condition, and your future goals. If the core mechanical structure is sound, a retrofit kit (like new sealing jaws or tension controls) to handle eco-friendly materials can be a cost-effective solution. However, if your goal is a significant increase in speed, rapid changeovers, and reduced manual intervention, the lower long-term Total Cost of Ownership (TCO) of a new machine with integrated automation and IIoT capabilities is often the better investment.

Q2: Will using eco-friendly or paper-based films really slow down my production?

A: With traditional machines, yes. These materials often have a narrower heat-sealing window, forcing a reduction in speed. However, modern machines designed for these materials, especially those equipped with ultrasonic sealing or intelligent temperature control systems, can achieve stable, high-quality seals at or near full speed, effectively solving this core challenge.

Q3: Are automated solutions like auto-splicing and cobots only for large corporations?

A: Not anymore. As technology matures, automation is becoming more modular and affordable. For SMEs, a great starting point is an easy-to-operate, entry-level VFFS machine to solve labor consistency issues. From there, you can implement a phased automation upgrade, adding modules like collaborative robot palletizers as your needs grow.

Q4: When choosing a new machine, what features are most critical for "flexibility"?

A: Three elements are key:

1) Rapid, tool-less changeovers that allow you to switch bag styles and sizes in minutes to handle the trend of shorter production runs;

2) Broad material compatibility to ensure the machine can run everything from legacy plastics to future recyclable mono-materials;

3) Open integration interfaces to easily connect with future coders, inspection systems, and data platforms.